This Wednesday, the National Insurance threshold will rise overnight from £9,880 to £12,570 — saving 30 million British workers up to £330 a year. It will also lift 2.2million people out of paying any National Insurance or income tax on their earnings at all.

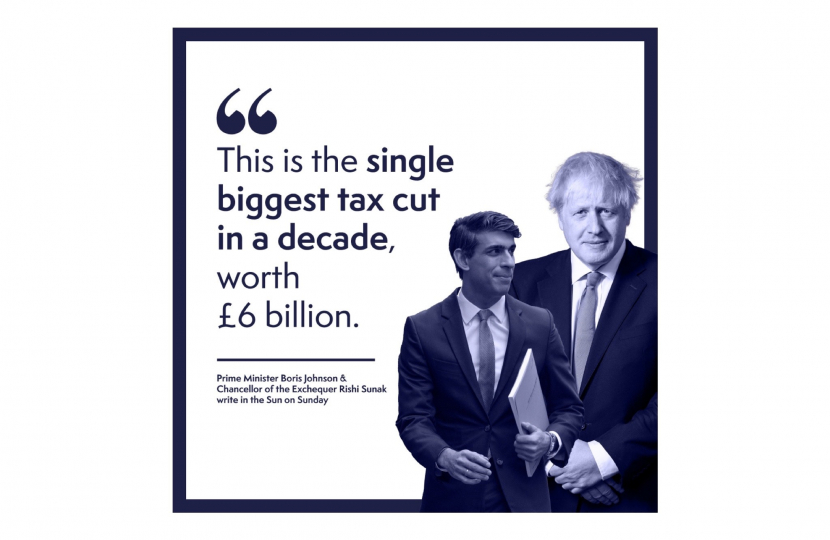

The £6 billion tax cut, which is the single biggest tax cut in a decade, means that 70% of people will pay less tax even after the Health and Social Care Levy - which is funding the biggest catch-up programme in NHS history and putting an end to spiralling social care costs. The cut means the UK now has some of the most generous tax thresholds in the world.

You can find out exactly what it will mean for you by visiting the Government’s calculator, which estimates how the National Insurance contributions changes will affect you.

Millions of households across the UK are struggling to make their incomes stretch to cover the rising cost of living. That is why the Government is helping households across the country with £37billion of financial support. This financial support includes a council tax rebate, a cut in fuel duty, at least £400 for every household to help with energy bills and at least £1,200 for the eight million most vulnerable households.

To see what support is available and whether you are eligible, please visit: https://costoflivingsupport.campaign.gov.uk/.